Eth becoming deflationary images are available. Eth becoming deflationary are a topic that is being searched for and liked by netizens now. You can Find and Download the Eth becoming deflationary files here. Download all free photos.

If you’re looking for eth becoming deflationary pictures information linked to the eth becoming deflationary keyword, you have pay a visit to the right blog. Our website frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

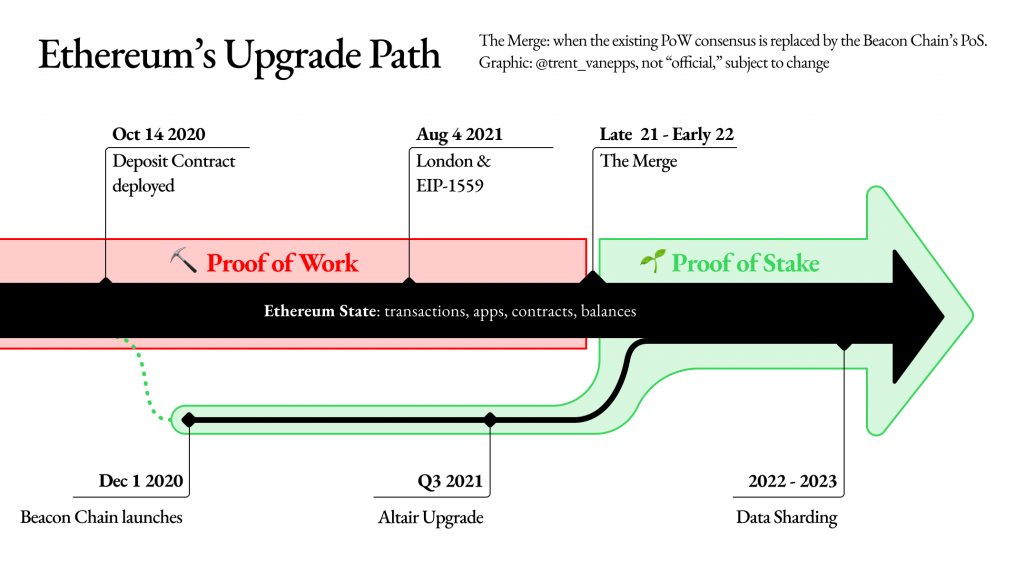

Eth Becoming Deflationary. As Ethereum Price Suffers Investors Wonder If ETH Can Become Deflationary. The Ethereum Foundation is set to implement the Ethereum. This marks the first time Etheruem issuance turns negative after the EIP-1559 proposal which added an element of deflation. Associated Checking Out Ethereum 20 Contract Reaches 100000 ETH Milestone.

A Guide To Ethereum S Deflationary London Hard Fork Coolwallet From coolwallet.io

A Guide To Ethereum S Deflationary London Hard Fork Coolwallet From coolwallet.io

With the current proof-of-model nearly 4 of the total Ethereum supply is issued. In the meantime the price of ETH. Annual gas fees could burn as much as 10 of unstaked ETH per year. ETH Burn Precludes Fixed Supply. But now a whole other question has arisen in regards to Ethereum and that is if the digital asset will ever become deflationary. As Ethereum Price Suffers Investors Wonder If ETH Can Become Deflationary.

The network is structured that for every new block created two ETH.

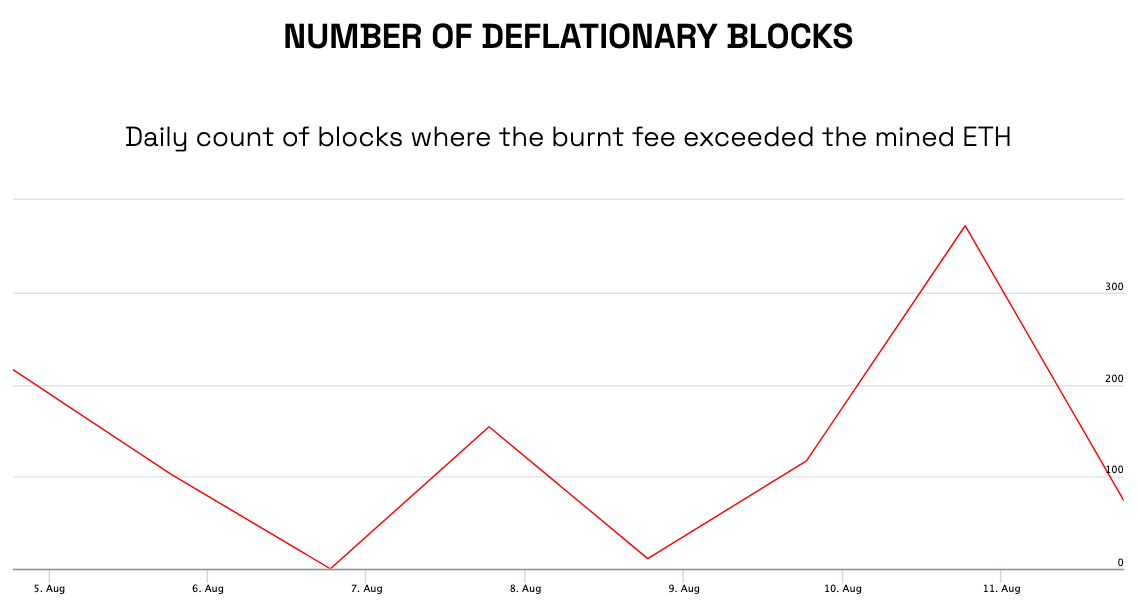

Ethereum was deflationary on September 3 as more ETH was burned than issued. ETH price could exceed current price predictions as it becomes a deflationary asset. According to Ethereum burning and inflation tracking service UltrasoundMoney with 10 million ETH an average base gas price of 20 Gwei and PoS being implemented on 31 March 2022 we should expect Ether to become deflationary at the very moment when it moves away from mining. A hypothetical scenario was proposed where in the year 2025 80 of ETH had been staked and the network has a deflation rate of 2. Ad Join the worlds largest trading appBuy and sell in minutes. With the new update the base fee from each Ethereum transaction gets burned deflating the supply of ETH.

Source: twitter.com

Source: twitter.com

And to balance the issuance rate by ETH. As Ethereum Price Suffers Investors Wonder If ETH Can Become Deflationary. With this change ETH. Ethereum has not been disregarded of the onslaught presently. A hypothetical scenario was proposed where in the year 2025 80 of ETH had been staked and the network has a deflation rate of 2.

Source: fxstreet.com

Source: fxstreet.com

The page called this out at the end that got me thinking about the potential for ETH to be deflationary in the long run. Ethereum has not been disregarded of the onslaught presently. One potential drawback when it comes to burning the base fee is the fact of losing control over the long term monetary policy of ETH. Today an entire other concern has actually occurred in concerns to Ethereum which is if the digital property will ever end up being deflationary. As Ethereum Price Suffers Investors Wonder If ETH Can Become Deflationary.

Source: mobile.twitter.com

Source: mobile.twitter.com

With the current proof-of-model nearly 4 of the total Ethereum supply is issued. But now a whole other question has arisen in regards to Ethereum and that is if the digital asset will ever become deflationary. Ethereum has not been disregarded of the onslaught presently. The network is structured that for every new block created two ETH. One potential drawback when it comes to burning the base fee is the fact of losing control over the long term monetary policy of ETH.

Source: fxstreet.com

Source: fxstreet.com

By burning the base fee we can no longer guarantee a fixed token supply. Firstly to become a deflationary asset the volume burnt must be higher than the ETH volume issued in block rewards. According to network data over 4418 ETH equivalent to over 121 million were burned in under 22 hours after the. Annual gas fees could burn as much as 10 of unstaked ETH per year. On the day of the transition there would be 120 million ETH.

Source: twitter.com

Source: twitter.com

Associated Checking Out Ethereum 20 Contract Reaches 100000 ETH Milestone. Ethereum To Become a Deflationary Asset and See Its Supply Reduced with Proposed EIP 1559 Upgrade. Today an entire other concern has actually occurred in concerns to Ethereum which is if the digital property will ever end up being deflationary. As Ethereum Price Suffers Investors Wonder If ETH Can Become Deflationary. As Ethereum Price Suffers Investors Wonder If ETH Can Become Deflationary.

Source: youtube.com

Source: youtube.com

One potential drawback when it comes to burning the base fee is the fact of losing control over the long term monetary policy of ETH. With the new update the base fee from each Ethereum transaction gets burned deflating the supply of ETH. Annual gas fees could burn as much as 10 of unstaked ETH per year. Ethereum has not been disregarded of the onslaught presently. ETH is becoming more scarce than.

Source: chaindebrief.com

Source: chaindebrief.com

20 2021 0700 PM. Ethereum To Become a Deflationary Asset and See Its Supply Reduced with Proposed EIP 1559 Upgrade. The most interesting data to watch in our industry for the next year. ETH price could exceed current price predictions as it becomes a deflationary asset. Annual gas fees could burn as much as 10 of unstaked ETH per year.

Source: bitboycrypto.com

Source: bitboycrypto.com

Create a Binance free account. When Will Ethereum Become A Deflationary Asset. ETH Burn Precludes Fixed Supply. As Ethereum Price Suffers Investors Wonder If ETH Can Become Deflationary. On one hand the cryptoeconomics are working.

Source: ambcrypto.com

Source: ambcrypto.com

When ETH burned by the protocol is greater than the mining reward the block produced is deflationary. All these factors may be making Ethereum more deflationary. Create a Binance free account. The Ethereum Foundation is set to implement the Ethereum. Firstly to become a deflationary asset the volume burnt must be higher than the ETH volume issued in block rewards.

But now a whole other question has arisen in regards to Ethereum and that is if the digital asset will ever become deflationary. With the current proof-of-model nearly 4 of the total Ethereum supply is issued. According to network data over 4418 ETH equivalent to over 121 million were burned in under 22 hours after the. With the new update the base fee from each Ethereum transaction gets burned deflating the supply of ETH. The network is structured that for every new block created two ETH.

The most interesting data to watch in our industry for the next year. On one hand the cryptoeconomics are working. But now a whole other question has arisen in regards to Ethereum and that is if the digital asset will ever become deflationary. And to balance the issuance rate by ETH. With this change ETH.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title eth becoming deflationary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.